-

Commercial

Commercial audit services

-

Insurance

Insurance audit services

-

Asset Management

Fund audit services

-

Solvent liquidations

Solvent liquidations

-

Cross border & domestic insolvency

Cross border & domestic insolvency

-

Asset tracing, investigation and recovery

Asset tracing, investigation and recovery

-

Corporate restructuring and recovery

Corporate restructuring and recovery

Mergers under 'common control' – a problem shared is a problem halved

Economic disruption wrought by COVID-19 continues to impact decision makers across industries. The insurance sector was no exception to the hardening marketplace, particularly for actors within the healthcare sector. Boards of directors require a creative and flexible approach to weather this storm.

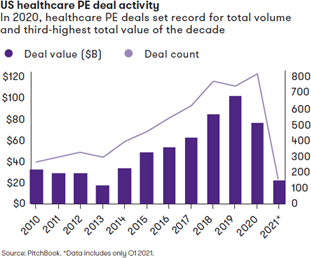

Insurance sector market trends

An increasing number of boards of directors have turned to the mergers and acquisitions ("M&A") space to re-structure core business and develop efficiencies resulting from operational synergies. As an indicator of the general M&A activity within the US healthcare sector, the industry recorded a new high for private equity deal activity in 2020, surpassing the record set in 2018. While the aggregate deal value fell in 2020, it still represents the third-highest annual aggregate deal value since 2010.

At Grant Thornton, Cayman Islands, we have seen a significant increase in 'common control' mergers post COVID-19 peaks, many of which are merging to adapt to the ever-increasing operational pressures presented by the pandemic and to reap the rewards of economies of scale.

Accounting treatment of M&A

Most business combinations are governed by International Financial Reporting Standard ("IFRS") 3: Business Combinations or Accounting Standards Codification ("ASC") Topic 805: Business Combination under the International and US Generally Accepted Accounting Principles ("US GAAP") accounting frameworks respectively; however, there is limited guidance on the specific instance of a merger under 'common control'.

IFRSs provide no authoritative guidance on the accounting for mergers under 'common control'. However, in practice, the most suitable accounting policies to apply are:

- the acquisition method; or

- the predecessor's value method.

Under US GAAP, the accounting for mergers under 'common control' are generally recognised at their historical carrying amounts, as reflected in the parent's financial statements. This guidance will focus on US GAAP.

What is 'common control'?

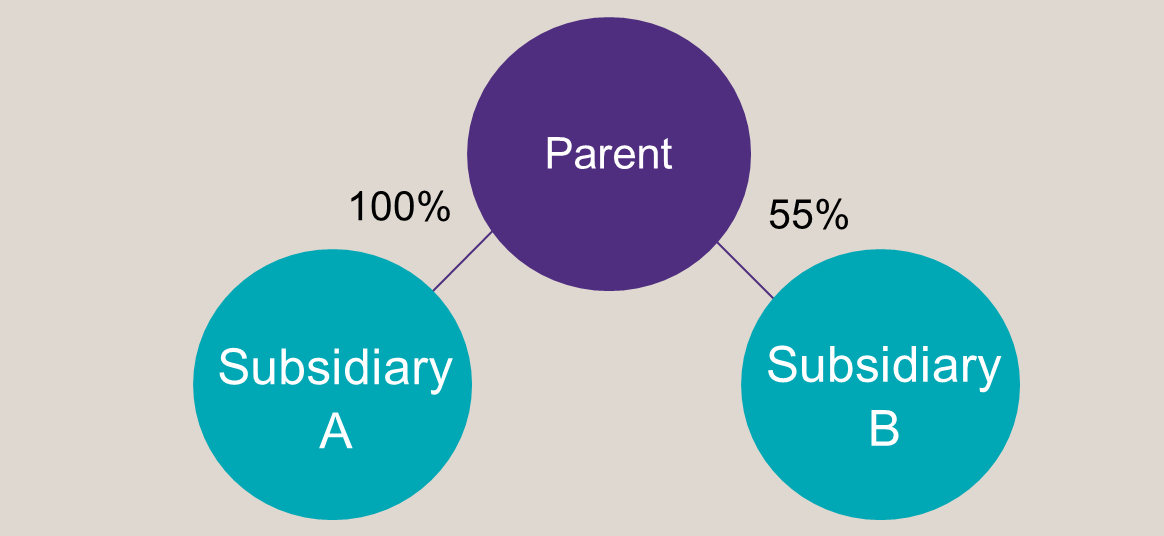

The most basic example of 'common control' is when a parent entity holds controlling interests (generally more than 50% of the voting shares) in both reporting entities.

The diagram above shows that Subsidiary A and Subsidiary B are under the 'common control' of the Parent.

A transaction under 'common control' is similar to a business combination for the entity that receives the equity interests or net assets; however, the transaction does not meet the definition of a business combination as there is no change in control over the net assets. Consequently, the accounting and reporting requirements for a transaction, such as a merger between entities under 'common control', falls outside the scope of the general guidance surrounding business combinations contained within ASC 805-10, ASC 805-20, and ASC 805-30. Instead, the guidance contained within the subsections of ASC 805-50 is applicable.

Under ASC 805-50, the 'pooling-of-interests' method exists for the accounting of a 'common control' merger, that results in a change in reporting entity. In essence, the 'pooling-of-interests' method requires the assets, liabilities and operations of the two entities to be combined at their historical carrying amounts, with all historical periods adjusted as if the entities had always been combined.

Pooling-of-interests

The following are some specific accounting considerations under the 'pooling-of-interests' method with a focus on account balances and transactions within the healthcare sector:

- The carrying values of the transferred net assets are added to the carrying values of the receiving entity's net assets. Should the receiving and transferring entity's accounting principles and policies differ, the balances "may be adjusted to the basis of accounting used by the receiving entity if the change would be preferable" under ASC 805-50-30-6.

- No goodwill is recognised. Should any consideration be made, any difference between the consideration given and the carrying amounts of the net assets received is recognised in equity (e.g., reflected as additional contributed capital or dividend paid / received in retained earnings).

- An actuary report for the transferring entity's loss provision is recommended at merger date to determine its carrying value.

- Should the transferring entity have any investments, the carrying value of these investments is typically its fair value at merger date.

- The receiving and transferring entities' results of operations are combined (after eliminating intercompany transactions) in the reporting period in which the merger occurs as though the entities had been combined as of the beginning of the reporting period (or from the date the entities became under 'common control' if they were not under 'common control' for the entire period).

- There are limited required disclosures to be made, such as the name and brief description of the transferring entity, the method of accounting used for the transfer of net assets and any other information relevant for the users of the financial statements.

About Grant Thornton

We are a network of independent assurance, tax and advisory firms made up of more than 50,000 people in over 135 countries, and we are here to help dynamic organisations unlock their potential for growth. Our distinctive client experience sets us apart. At Grant Thornton, we have the people, the technology and the credentials to support our industry experience that is relevant to you.

Contact us

If you would like a detailed understanding of the 'pooling-of-interests' method or mergers under 'common control', please do not hesitate to contact the Grant Thornton, Cayman Islands team or one of the contributors below who are more than happy to help you navigate the complexities of these transactions and accounting treatments.

Dara Keogh

Managing Partner

Alan Shek

Senior Manager

Preshan Moodliar

Audit Manager